Special Insight : India GST changes – impact on paper sector

The GST effect – Kraft and corrugation businesses face higher costs

23 September 2025

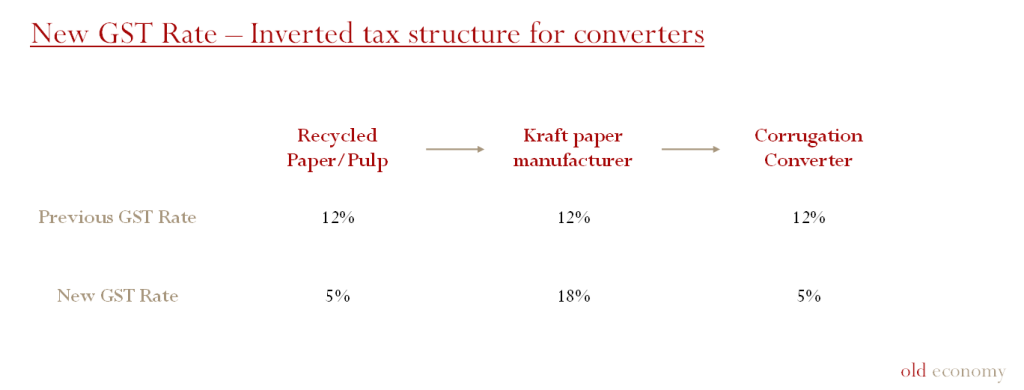

In new rates that became effective on 22nd September 2025, the GST Council of India increased the tax rate on paper and paperboard from 12% to 18%, while pulling the tax on corrugated boxes down to 5%, from 12% earlier. The GST hike on upstream while reduction on downstream creates an inverted GST structure that has put converters under pressure due to higher working capital requirements. Paper manufacturers selling on credit will also need to bear higher working capital costs.

“As a manufacturer, my working capital will rise. Converters will now require more time to clear the credit amount as they are unable to pass on the hike in production costs to customers” a top kraft paper manufacturer in northern India told Old Economy.

“Pressure on converters is going to put some stress on paper sales as well. When there is such stress, micro and small units are going to face a tough time as meeting capital requirements can be difficult. Capital has one of the highest shares in our costs”, he added.

Though converters will get a refund on the tax differential, the process involves a few weeks. An official at India’s Paper Manufacturers Association said, “The government should bring kraft paper in line with boxes as the differential of 13% will not benefit a B2B segment. Converters will have to bear with the refund process which is long and leads to a block on working capital.”

Mr. Pradip Agarwal, President of Eastern India Corrugated Box Manufacturers’ Association in Kolkata said that in the input tax credits process, only 90% of the tax credit is refunded provisionally, with the remaining 10% to be processed later.

He added that since the implementation of the new GST rate structures, October 20th is the first time GST returns will be filed, and businesses will keenly observe the ease and speed of refund.

The second, and larger impact, is in the inability of corrugated box manufacturers to claim input tax credit on a host of services used, as well as the loss of tax credit on capital goods. With the inverted structure on corrugators now, input tax credit cannot be claimed on business expenses such as contracted labour and rent, all of which attract a GST of 18%. Moreover, GST paid during capital expenses, on machinery for example, cannot be claimed as credit anymore.

Mr. Agarwal estimated the combined impact of the inverted GST structure on cost of production to be 7-9%. Downstream buyers such as the FMCG sector are working through GST changes of their own, but it is already clear that willingness to pay more for packaging boxes is low.

Any GST rate change unlikely until the Council reconvenes

The industry body has submitted a proposal to the government to change tax on kraft paper to 5% instead of 18%, to put it at par with the value chain. However, this may not be reviewed until the next meeting of the GST Council, as yet unscheduled.

A corrugator said, “Ultimately, if there is no revision in GST by year end, then converters will start looking at passing on their costs to consumers. Most of the clients are multinational corporations (MNCs) and a rise in working capital due to GST amendments doesn’t allow the contract price with the buyer to change. Only a high variation in paper prices allows for a change.”

GST impact on other paper categories

GST on uncoated printing and writing paper has risen from 12% to 18%. Manufacturers said enquiries were low, and order volumes had reduced as printers are facing a rise in costs and finding it difficult to pass on their costs to buyers.

GST on pulp and waste paper has been lowered from 12% to 5%.

Newsprint saw no change in GST rate, which remains at 5%. GST on tissue stock also remained unchanged at 18%.